This weeks’s CXChronicles, Podcast #218, welcomed Verde Group’s Executive Vice President, Dennis Armbruster. The Verde Group is a customer experience consultancy, creating value by employing a proprietary research methodology that is based on a fundamental principle of human behavior: Individuals are far more likely to take action in response to negative events than positive ones. […]

In the News

Science of CX: Implementing CX Initiatives Amidst the Current Digital Transformation with Paula Courtney

Steve Pappas, host of Science of CX podcast, sits down with Paula Courtney to dive into the science of CX and the importance of identifying and addressing pain points to boost revenue. The podcast also discusses the growing need for human connection in business settings and the challenges companies face in bringing employees back to […]

In the News

Idea: Understanding Friction in the Customer Experience

The customer experience impacts us all. When you enter a store the journey begins. Everything from how you find the items you are looking for to the actual purchasing process, every step makes an impression on how you evaluate a business. This reins true in the industrial manufacturing sector as well as the markets are […]

In the News

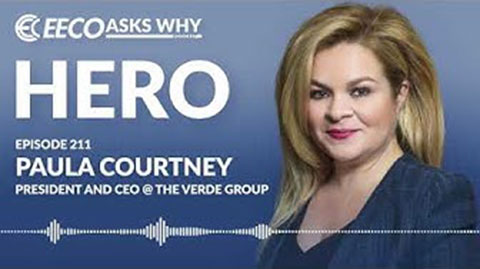

Hero: Paula Courtney – CEO & President at The Verde Group

Verde Founder and CEO, Paula Courtney joins EECO Ask’s Why, a podcast that dives into industrial manufacturing topics and spotlights the heroes that keep America running. Learn more about Paula in this in-depth Q&A. […]

In the News

Flip The Switch With Guest Paula Courtney

The Verde Group CEO, Paula Courtney recently joined host David Millay on Flip the Switch, a leading podcast that discusses customer and employee experience in sports and entertainment. Watch now as Paula and David discuss the five key elements that determine whether or not a customer buys from you again, the only currency in business […]

In the News

Surprising Insights into the Pandemic Consumer

The Verde Group CEO, Paula Courtney chats with Retail Council of Canada podcast “The Voice of Retail” about the impact of COVID-19 on consumers. Have consumer expectations changed? What must retailers do to succeed in this new world? Is it too late? Listen now and hear Paula and host Michael LeBlanc discuss this and more. […]

In the News

Profiting from Customer Dissatisfaction

By Theresa Lina, Author, The Apollo Method. The Apollo Space Program. Tesla. Disney. Salesforce. Apple. LEGO. Amazon. These are just a few of the many inspiring case studies in my book, Be the Go-To: How to Own Your Competitive Market, Charge More, and Have Customers Love You For It. And though nearly all of the […]

In the News

The Verde Group Speaking at Pharma CX 2019 Summit

Pharma CX 2019 is only a couple of weeks away! We’re thrilled to have our very own Jon Skinner share his firsthand knowledge and deep expertise regarding customer experience in the pharma industry. He’ll be joining other pharma CX leaders focused on driving digital transformation and outcomes through better customer experiences. Don’t miss out on […]